Government Loan Limits Increase 2025

FHA Limits

FHA announced the new FHA loan limits for case numbers assigned on or after

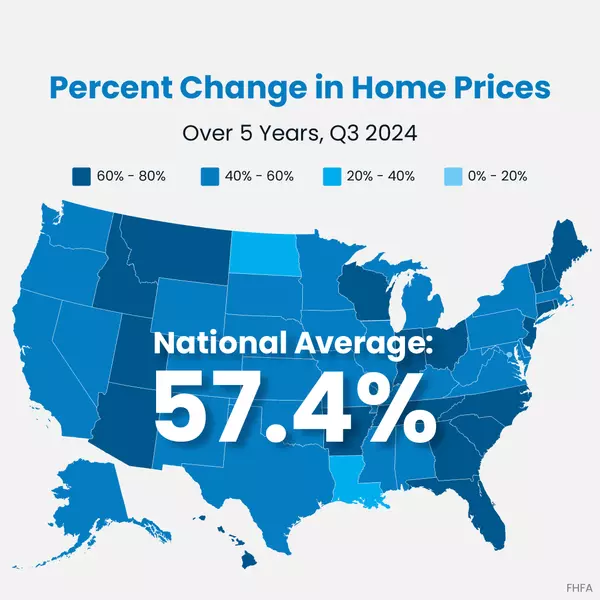

January 1, 2025. Nearly all U.S. counties will have an increase in loan limit in 2025. FHA is increasing the limit on 1-unit properties from $498,257 to $524,225, an increase of almost 5.25%. High-cost areas will also see an increase from $1,149,825 to $1,209,750. The FHA case number must be assigned on or after January 1, 2025 in order to use the new limit regardless of when the application is taken. You may view the limits by individual county on HUD’s Maximum Mortgage Limits web page.

FHA Earliest closing/funding date using the new 2025 limits:

-

To use the 2025 limit, the case number must be ordered on or after January 1st, 2025, therefore the earliest closing date will be January of 2025.

FHA Case Numbers assigned in 2024 wishing to use the new 2025 limit:

-

Case numbers assigned prior to January 1, 2025, wanting to use the new 2025 limits must be cancelled. And a new case number must be assigned on or after Jan. 1, 2025, in order to use the increased limits. No Exceptions.

Pricing FHA loans using the new 2025 limits:

Optimal Blue is updated with the new FHA limits. Within Optimal Blue, in the bottom left corner is a FHA case number assigned date dropdown. The dropdown currently defaults to 2024 case number dates, so just change it to “on or after 1/1/2025”.

The “On or after 1/1/2025” selection will become the default option on new OB registrations starting December 31,2024.

See example: FHA Case Number Assigned Date Dropdown

*NOTE* Not all investors are currently accepting locks on 2025 limits yet. Optimal Blue will automatically be updated as those investors announce effective dates.