How to Dispute Experian Credit Report Errors: A Complete 2025 Guide

Correcting Errors: A Step-by-Step Guide to Disputing a Derogatory Item on Your Experian Credit Report If you've discovered a derogatory mark on your Experian credit report that you believe is inaccurate, you have the right to dispute it. The Fair Credit Reporting Act (FCRA) mandates that credit bu

First Time Homebuyer : $2500 GRANT

Effective April 2025, FHFA grants have been suspended immediately. Programs and funding opportunities are constantly evolving. Staying informed and taking action when opportunities arise is essential for building wealth. Contact a Real Estate Strategist to explore current opportunities and maximize

Time in the Market Beats Timing the Market

Trying to decide whether it makes more sense to buy a home now or wait? There’s a lot to consider, from what’s happening in the market to your changing needs. But generally speaking, aiming to time the market isn’t a good strategy – there are too many factors at play for that to even be possible. Th

Another Low Down Payment Option --> ONE +

We’re making homeownership a reality for more clients with a new low down payment option, ONE+ Increasing interest rates, housing prices and inflation have made more clients pause their home search. Not anymore. With this new low down payment product, we can get those clients back into the market

If buying a home is on your goal sheet this year, there are things you need to do now to make it happen

If buying a home is on your goal sheet this year, here’s how to make it happen. Focus on improving your credit, planning for your down payment, getting pre-approved, and prioritizing your wish list. But first, let’s connect so you have expert advice every step of the

Why Owning a Home Is Worth It in the Long Run

Today’s mortgage rates and home prices may have you second-guessing whether it's still a good idea to buy a home right now. While market factors are definitely important, there’s also a bigger picture to consider: the long-term benefits of homeownership. Think of it this way. If you know people wh

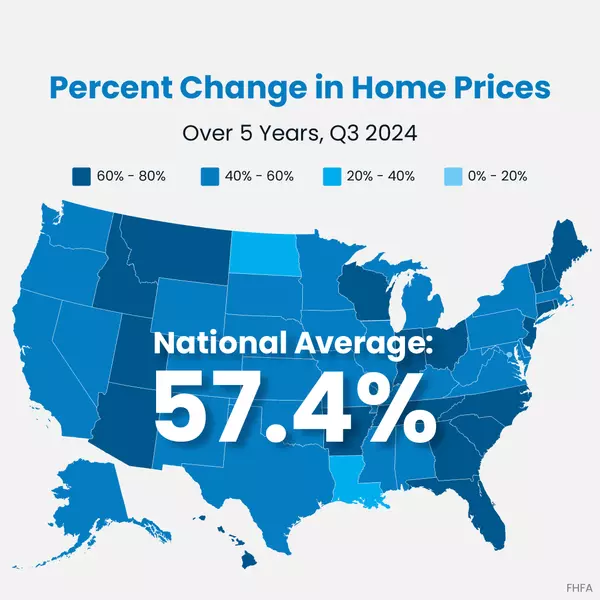

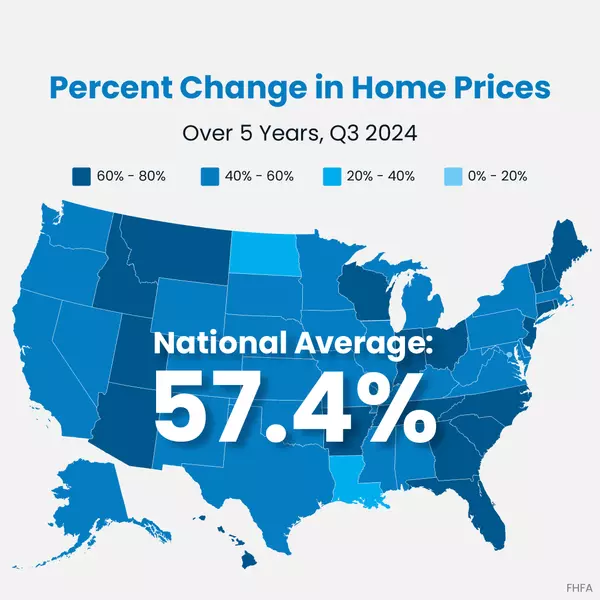

Percent Change in Home Prices

Did you know? The average home’s value went up by more than 57% over the past 5 years. And if you expand that to roughly 30 years, home values have more than tripled. That gives homeowners a big boost to their net worth. So, if you’re ready and able to buy, DM me, and let’s find something that work

2025 Housing Market Forecasts: What To Expect

Looking ahead to 2025, it's important to know what experts are projecting for the housing market. And whether you're thinking of buying or selling a home next year, having a clear picture of what they’re calling for can help you make the best possible decision for your homeownership plans. Here’s an

How the Economy Impacts Mortgage Rates

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what's ahead. One thing that can affect mortgage rates is the Federal Funds Rate, which influences how much it costs banks to borrow money from each other. While the Fed

What To Expect from Mortgage Rates and Home Prices in 2025

Curious about where the housing market is headed in 2025? The good news is that experts are offering some promising forecasts, especially when it comes to two key factors that directly affect your decisions: mortgage rates and home prices. Whether you're thinking of buying or selling, here’s a look

Categories

Recent Posts