The Limits of Online Home Valuation Tools Bankrate Quote

Don’t rely on online estimates to figure out what your house is worth. While they’re definitely convenient, they’re not 100% accurate. That's because they don’t include key details like your home’s condition, updates you’ve made, and what’s happening right here in our local market. Want to know th

Home Staging FAQ: What You Need To Know

Home Staging FAQ: What You Need To Know You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort? Here are a few quick FAQs that can help you decide how much you should priori

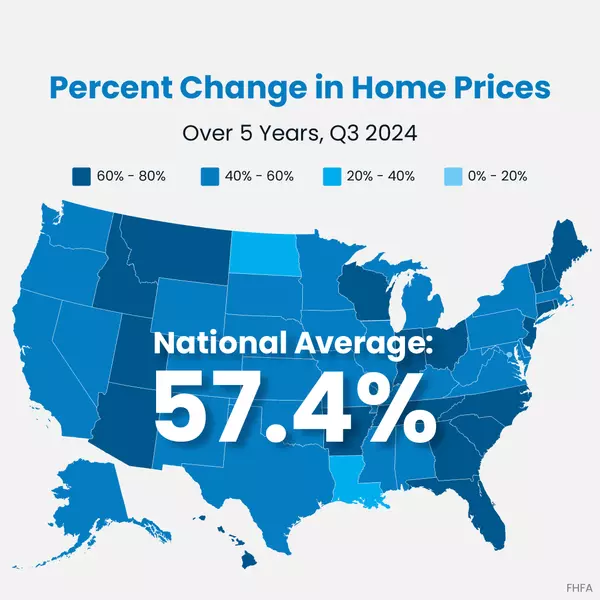

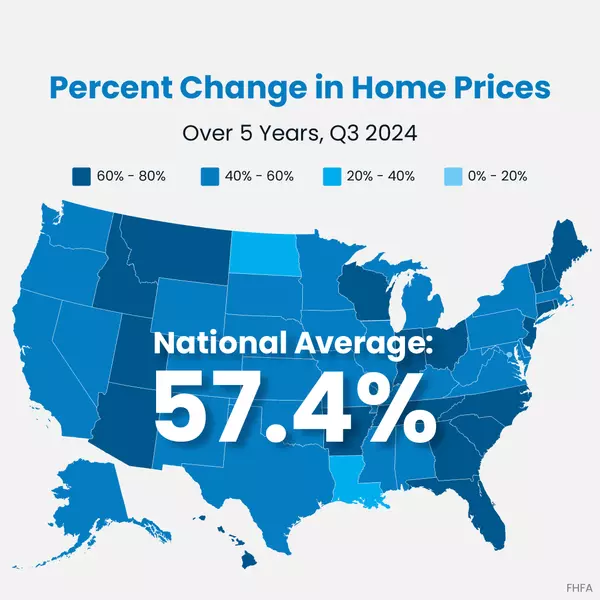

Percent Change in Home Prices

Did you know? The average home’s value went up by more than 57% over the past 5 years. And if you expand that to roughly 30 years, home values have more than tripled. That gives homeowners a big boost to their net worth. So, if you’re ready and able to buy, DM me, and let’s find something that wo

2025 Housing Market Forecasts: What To Expect

Looking ahead to 2025, it's important to know what experts are projecting for the housing market. And whether you're thinking of buying or selling a home next year, having a clear picture of what they’re calling for can help you make the best possible decision for your homeownership plans. Here’s a

How the Economy Impacts Mortgage Rates

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what's ahead. One thing that can affect mortgage rates is the Federal Funds Rate, which influences how much it costs banks to borrow money from each other. While the Fe

What To Expect from Mortgage Rates and Home Prices in 2025

Curious about where the housing market is headed in 2025? The good news is that experts are offering some promising forecasts, especially when it comes to two key factors that directly affect your decisions: mortgage rates and home prices. Whether you're thinking of buying or selling, here’s a loo

Q&A: How Do Presidential Elections Impact the Housing Market

How the upcoming election is going to impact the housing market? Here are your answers. Based on historical data, mortgage rates tend to decrease leading up to an election, while home prices and sales increase the year after the election. " href="https://">

Secrets To Selling Your House Quickly

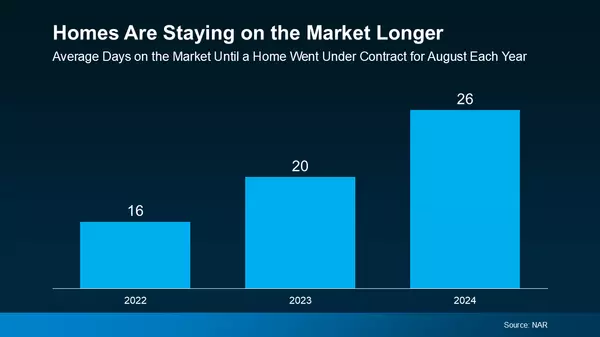

Seeing your house sit on the market without any bites is the ultimate frustration. And unfortunately, some sellers are in that tricky spot today. According to data from the National Association of Realtors (NAR), the average time a house spends on the market has increased over the past few years (s

4 Signs Your House Is Overpriced

You want your house to sell quickly and for top dollar. But pricing it too high can seriously jeopardize those goals. So, once your house is listed, watch out for these 4 signs that it's overpriced. And if any of these are happening to you, be sure to lean on your agent to course correct. #reales

Where Will You Go After You Sell?

If you’re planning to sell your house and move, you probably know there’s been a shortage of options available. But here’s the good news: the supply of homes for sale has grown in a lot of markets this year – and that’s not just existing, or previously-owned, homes. It’s true for newly built home

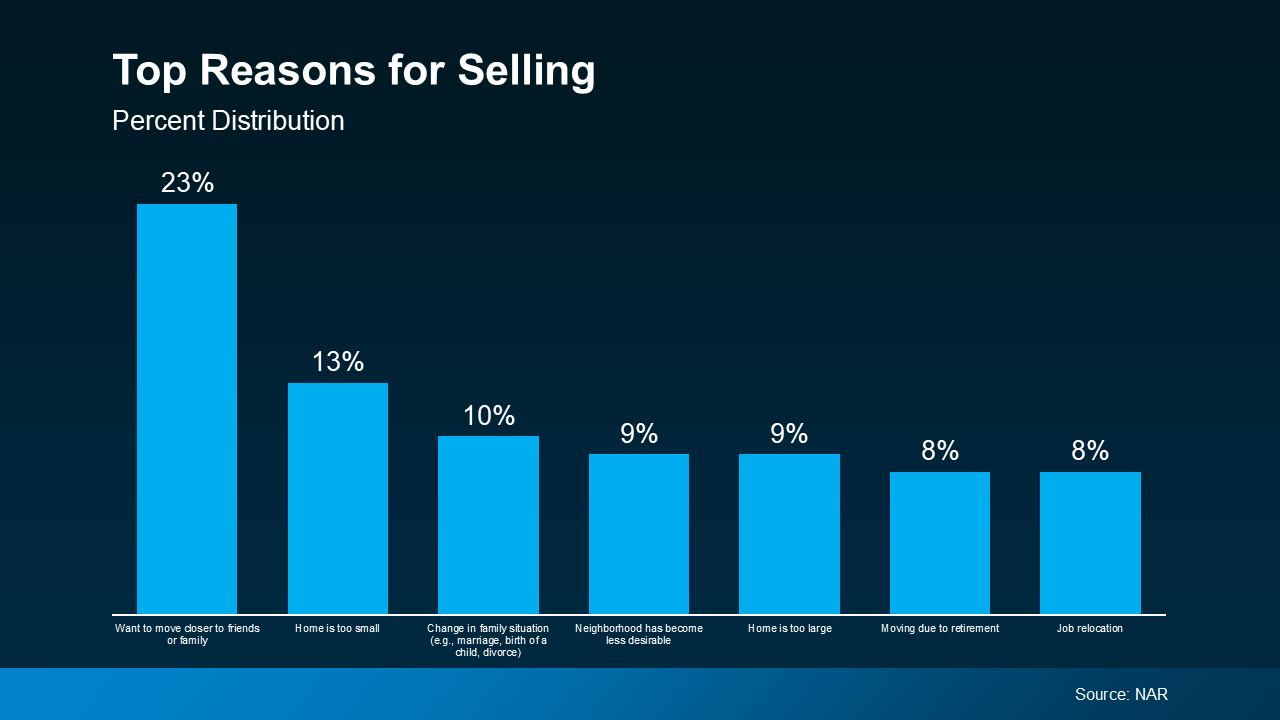

Should You Sell Now? The Lifestyle Factors That Could Tip the Scale

Are you on the fence about whether to sell your house now or hold off? It’s a common dilemma, but here’s a key point to consider: your lifestyle might be the biggest factor in your decision. While financial aspects are important, sometimes the personal motivations for moving are reason enough to m

Strategies : Selling Your Home -Preparation is Key

Selling a home is a significant milestone that requires careful planning and execution. The process can be overwhelming, but with the right strategies in place, you can increase your chances of a smooth and successful sale. One crucial aspect of selling your home is proper preparation. Here are s

Categories

Recent Posts