Everything about USDA Loans

When it comes to purchasing a home, especially in rural areas, many potential buyers are unaware of the benefits and opportunities offered by USDA loans. These government-backed mortgages are designed to help individuals and families achieve homeownership in eligible rural and suburban areas. In this blog, we will explore everything you need to know about USDA loans, focusing on buyers, mortgage specifics, and the neighborhoods they can help you access.

### Understanding USDA Loans

USDA loans are part of the U.S. Department of Agriculture’s Rural Development program. They aim to promote economic growth and improve the quality of life in rural America. One of the most attractive features of these loans is that they require no down payment, making them an appealing option for first-time homebuyers or those with limited savings.

### Who Can Benefit?

**Buyers**

USDA loans are particularly beneficial for low-to-moderate-income buyers who may struggle to qualify for conventional financing. To be eligible, borrowers must meet specific income requirements, which typically *cannot exceed 115% of the median income for their area. This makes USDA loans an excellent option for families looking to stretch their budgets without sacrificing their dream of homeownership.

*USDA Income Eligibility .pdf Document Download

https://www.rd.usda.gov/sites/default/files/rd-grhlimitmap.pdf

Additionally, borrowers must have a credit score of at least 640 to qualify for a USDA loan (*subject to lender overlays). However, those with lower scores may still be able to secure financing through manual underwriting processes. It’s essential for potential buyers to consult with lenders experienced in USDA loans to understand their options fully.

### The Mortgage Process

**Mortgage Specifics**

The mortgage process for a USDA loan is similar to that of conventional loans but has some unique aspects worth noting. First and foremost, the application process involves proving eligibility based on location and income. Lenders will verify that the property is situated in an eligible rural area as defined by the USDA.

Once approved, borrowers can take advantage of competitive interest rates often lower than those found in conventional financing. Additionally, USDA loans do not require private mortgage insurance (PMI), which can save borrowers hundreds of dollars each month.

There are two types of USDA loans: Guaranteed Loans and Direct Loans. Guaranteed Loans are issued by approved lenders and backed by the USDA, while Direct Loans are provided directly by the government to low-income applicants. Understanding which type best suits your needs is crucial in navigating the mortgage landscape effectively.

### Finding Your Dream Neighborhood

**Neighborhood Considerations**

One significant advantage of USDA loans is access to a variety of neighborhoods that might otherwise be overlooked by homebuyers focusing on urban settings. Many eligible areas offer spacious homes at affordable prices while providing a serene environment away from city congestion.

When considering neighborhoods for a USDA loan, it’s essential to look at factors such as local amenities, schools, and community services. Many rural areas have strong community ties and offer a slower-paced lifestyle that appeals to families seeking safety and tranquility.

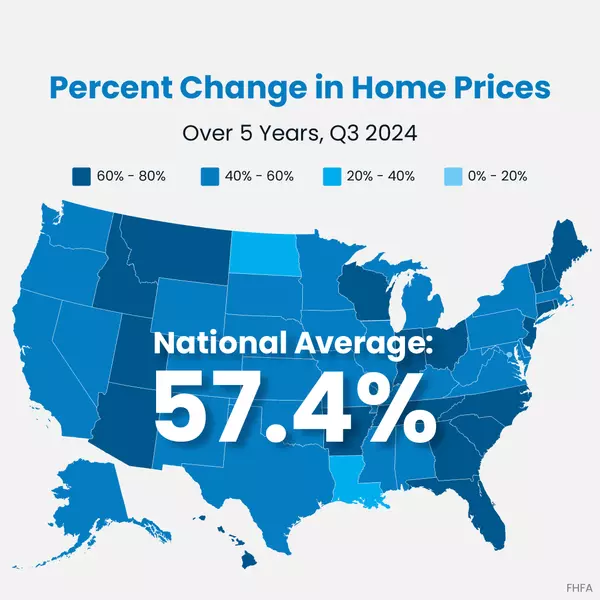

Moreover, prospective buyers should research local market conditions as well as future development plans that could enhance property values over time. Some regions may offer incentives for new businesses or infrastructure improvements that could positively impact your investment.

Check the USDA Property Eligibility MAP here:

https://evergreennw.shortcm.li/USDA_Property_Eligibility

### The Application Journey

The journey toward securing a USDA loan can seem daunting at first glance; however, understanding each step can simplify the process significantly:

1. **Pre-Qualification:** Start by finding a lender who specializes in USDA loans and get pre-qualified based on your financial situation.

https://evergreennw.shortcm.li/USDA_Income_Eligibility

2. **Property Search:** Look for homes within eligible areas while keeping your budget in mind.

https://evergreennw.shortcm.li/USDA_Property_Eligibility

3. **Application Submission:** Once you find your ideal property, submit your application along with necessary documentation like proof of income and credit history.

4. **Underwriting:** The lender will review your application during this phase; they may request additional information or clarification.

5. **Closing:** If approved, you’ll move on to closing where you’ll sign documents finalizing your mortgage agreement.

### Conclusion

USDA loans present an incredible opportunity for many buyers looking to purchase homes in rural or suburban settings without hefty down payments or high-interest rates. With favorable terms designed specifically for low-to-moderate-income families, these loans can pave the way toward achieving homeownership dreams.

If you're considering buying a home in an eligible area or want more information about how these loans work, reach out to local lenders who specialize in USDA financing. The journey may seem complex at first glance; however, with proper guidance and preparation, you could soon find yourself settling into your new home surrounded by nature's beauty and community warmth!

Categories

Recent Posts