MY BLOGS

AFFORDABILITY CALCULATOR

Quite affordable.

EXPLORE OUR FEATURED AREAS

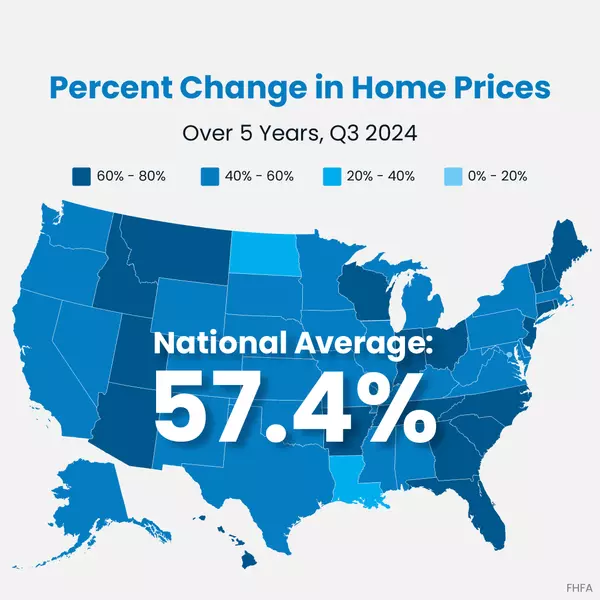

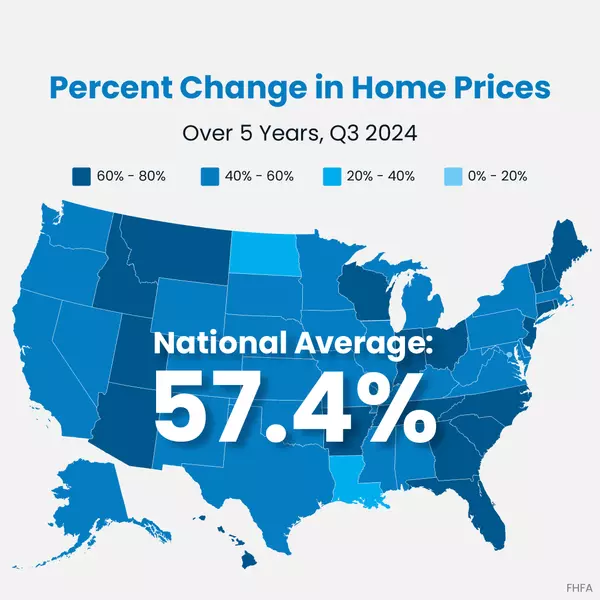

Percent Change in Home Prices

Did you know? The average home’s value went up by more than 57% over the past 5 years. And if you expand that to roughly 30 years, home values have more than tripled. That gives homeowners a big boost to their net worth. So, if you’re ready and able to buy, DM me, and let’s find something that work

2025 Housing Market Forecasts: What To Expect

Looking ahead to 2025, it's important to know what experts are projecting for the housing market. And whether you're thinking of buying or selling a home next year, having a clear picture of what they’re calling for can help you make the best possible decision for your homeownership plans. Here’s an

How the Economy Impacts Mortgage Rates

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what's ahead. One thing that can affect mortgage rates is the Federal Funds Rate, which influences how much it costs banks to borrow money from each other. While the Fed

Categories

Recent Posts